At a Glance

- TurboTax earns 8.2/10 overall, ranking high in eligibility and features but low in affordability.

- The free tier covers simple returns, but most users face hidden fees and nudges to upgrade.

- Pricing is the priciest among competitors, with dynamic rates that rise as April 15 approaches.

- Why it matters: Taxpayers can save hundreds if they choose the right tier or a cheaper alternative.

When the 2026 tax season looms, taxpayers often face a maze of software options. News Of Fort Worth evaluated TurboTax, the market leader with 60% market share, to see if its premium price is justified.

Price and Affordability

TurboTax’s pricing structure is the most complex among the services tested. While a free DIY tier exists, most users are pushed toward paid plans, and the cost can climb sharply as deadlines near. The software also uses dynamic pricing, so the final amount can change by the time you submit your return.

| Tier | Who can use it | What it covers | Price range |

|---|---|---|---|

| Do It Yourself | Simple 1040 filers | Federal & state return | $0 to $139 (discounted to $0 to $99) |

| Expert Assist | All individual filers | DIY + live support & expert review | $79 to $209 (discounted to $39 to $159) |

| Expert Full Service | All individual filers | Expert prepares, signs & files | $150 (special offer) |

The tier prices are only the base; state filing fees add to the total, and many features trigger additional charges.

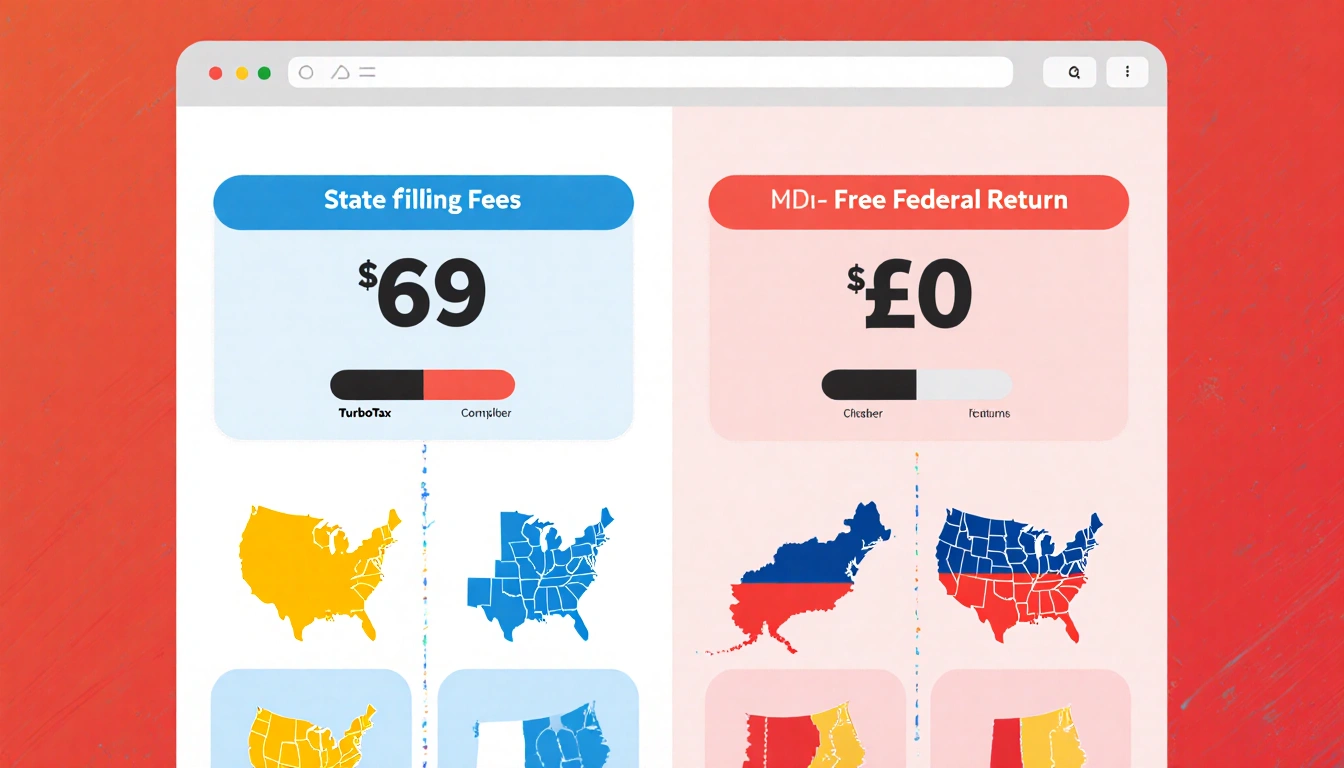

State Filing Fees

State fees vary widely across providers. TurboTax’s fees can reach $69 for a paid product, while some competitors offer free state returns if you qualify for the free federal tier.

| Service | State filing fee |

|---|---|

| Cash App Taxes | $0 (one return) |

| FreeTaxUSA | $15.99 |

| H&R Block | $37 for paid plans, $0 if free |

| Jackson Hewitt | $0 (flat fee) |

| TaxAct | $39.99 |

| TaxSlayer | $39.99 (or free for simple) |

| TurboTax | $0 to $69 (discounted to $0 to $49) |

Because the fee climbs with the tier, taxpayers who need a premium plan pay more for each state.

Hidden Costs and Upgrades

TurboTax claims about 37% of users qualify for a free federal and state return, but most situations-like freelance income or itemized deductions-force a paid upgrade.

- Freelance income

- Investment income

- Rental income

- Foreign tax credits

- Complex deductions

The $40 refund processing fee applies if you choose to deduct filing fees from your refund; paying by card avoids it. TurboTax also offered a $59.99 Max Defend & Restore package early in the filing process.

Eligibility and Use Cases

TurboTax covers virtually every filing scenario, from a simple W-2 return to complex self-employment and investment income.

- Simple filers (standard deduction)

- Investment income (Schedule D)

- Self-employment (Schedule C)

- Rental income (Schedule E)

- Foreign tax credits (Form 1116)

The free tier is available for standard deduction filers, but it excludes many credits and deductions, such as unemployment income or student loan interest.

Experience and Ease of Use

The software’s clean interface and guided interview make onboarding fast, but frequent upgrade prompts can interrupt the flow.

- Import tools for W-2s, 1099s, and last year’s return

- Mobile and desktop sync for a seamless experience

- Real-time refund updates show expected refund or tax bill

Users can import last year’s return or upload W-2s and 1099s directly from employers or financial institutions, reducing manual entry.

Features

TurboTax offers a robust set of tools, from error checking to audit support, but lacks built-in audit defense.

- Final accuracy check scans for common IRS mistakes

- Audit risk assessment (removed from online versions but present in desktop)

- AI-powered Intuit Assist provides free guidance

- Refund advance can give up to $4,000 just 30 seconds after IRS acceptance

- Max Defend & Restore offers audit defense for an extra fee

The AI-powered Intuit Assist answers questions as you prepare your return, and the refund advance is available starting in late January.

Expert Support

Paid tiers unlock access to certified tax professionals, though the cost can be steep.

- Expert Assist Basic starts at $79 (discounted to $39) for simple 1040 filers

- Availability 5 a.m. to 9 p.m. PT, seven days a week

- In-person support limited to certain states and hours

- Expert Full Service includes a signed return and face-to-face support in select locations

Final Verdict

TurboTax delivers a comprehensive product, but its price and hidden costs can frustrate users. The free tier works well for simple returns, while premium tiers provide value for complex situations. Cheaper alternatives may be better for low-budget filers.

TurboTax Score Breakdown

| Category | Score |

|---|---|

| Price and affordability | 5/10 |

| Eligibility and use cases | 10/10 |

| Experience and ease of use | 9/10 |

| Features | 9/10 |

| Expert support | 8/10 |

| Overall score | 8.2/10 |

Methodology

The review evaluated each platform on five criteria-price, eligibility, experience, features, and expert support-using identical tax scenarios on mobile and desktop.

- Price: base and add-ons, transparency of costs

- Eligibility: range of filing scenarios tested

- Experience: onboarding, navigation, and user interface

- Features: error checking, audit support, refund advance

- Expert: access to certified professionals and support hours

Key Takeaways

- TurboTax’s 8.2/10 score reflects strong eligibility and features but weak affordability.

- The free tier covers simple returns, but most users will pay for upgrades or state fees.

- For taxpayers seeking advanced guidance, the premium tiers offer value, but cheaper options may be better for simple filings.

Choosing the right tax software depends on your filing complexity and budget. TurboTax offers powerful tools, but its premium pricing and frequent nudges may make other options more appealing for many taxpayers.