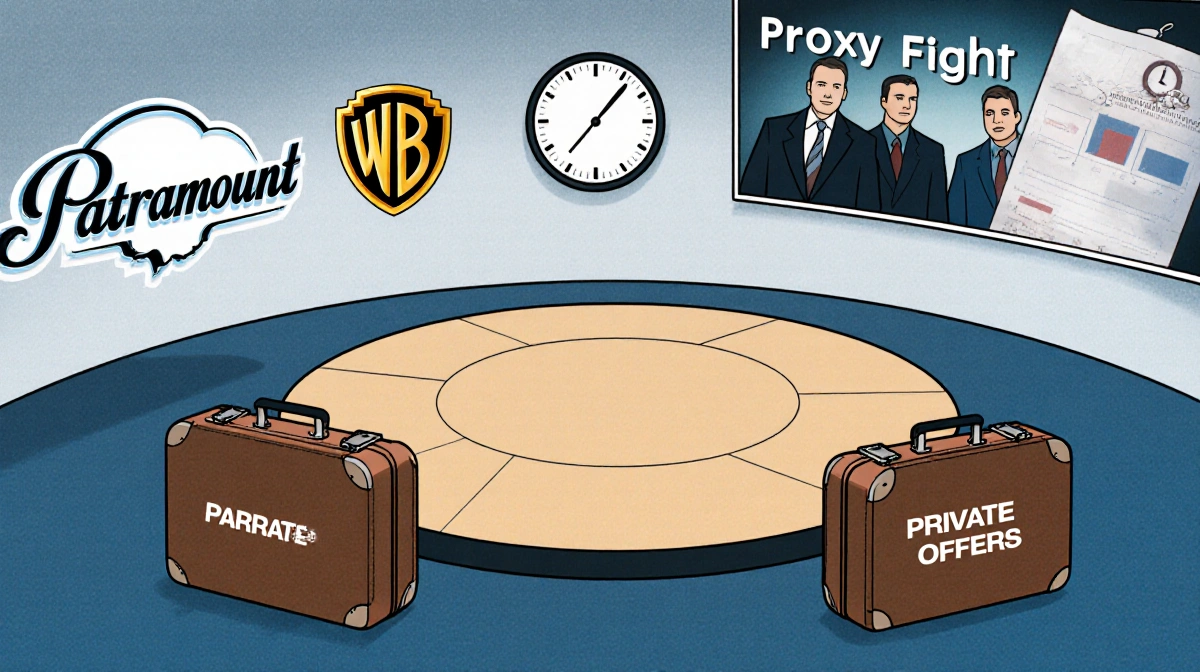

Paramount has cranked up its fight for Warner Bros. Discovery by launching both a proxy battle and a lawsuit aimed at derailing the pending sale to Netflix.

At a Glance

- Paramount has nominated its own directors for WBD’s 2026 annual meeting to block the Netflix deal

- The company also sued WBD in Delaware Chancery Court to force disclosure of financial details

- Netflix’s offer is $28 per share, Paramount’s is $30 per share, but Netflix wants only parts of WBD

- Regulatory review will stretch at least a year regardless of which bid wins

Why it matters: Shareholders now face competing visions for WBD’s future, and the final outcome will reshape Hollywood’s studio landscape.

The battle heated up in December after Paramount began a hostile bidding war. According to News Of Fort Worth‘s reporting, “David Ellison’s Paramount said it intends to nominate directors for election at the Warner Bros. Discovery 2026 annual meeting to solicit against the approval of the Netflix transaction.”

Lawsuit Seeks Hidden Numbers

Paramount’s Delaware suit demands that WBD release “basic information to enable WBD shareholders to make informed [decisions]” on whether to accept Netflix’s offer. The move follows multiple rejections of Paramount’s richer $30-per-share bid.

Key differences between the two offers:

| Aspect | Netflix Offer | Paramount Offer |

|---|---|---|

| Price per share | $28 | $30 |

| Assets sought | Film/TV studios, streaming, gaming | Entire company |

| Status | Accepted by board | Rejected multiple times |

Warner Bros. Fires Back

In a statement carried by Variety, Warner Bros. labeled the lawsuit “meritless,” arguing that Paramount “has yet to raise the price or address the numerous and obvious deficiencies of its offer.” The board reiterated that the Netflix pact “is not superior to the merger agreement with Netflix,” citing unresolved issues in Paramount’s proposal.

Timeline of the Chase

- Summer 2024 – Paramount closes its Skydance merger and begins circling WBD

- Late 2024 – Paramount makes three private offers

- December 2024 – WBD opens bidding to other suitors and signs with Netflix

- January 2025 – Paramount launches proxy fight and lawsuit

No date has been set for the WBD annual meeting where shareholders will vote on board makeup and, by extension, the Netflix deal. Even after a victor emerges, antitrust and regulatory approvals will keep the companies in limbo for at least another year.

Key Takeaways

- Paramount is betting that forcing open the books will sway shareholders toward its higher all-inclusive bid

- WBD’s board maintains that Netflix’s lower offer is more favorable because it avoids the structural risks Paramount’s total buyout would bring

- With both sides digging in, the contest will play out in both the courtroom and the shareholder ballot box over the next twelve months