Bitcoin mining’s waste heat is warming entire cities, with one Nordic project now heating 80,000 residents across Finland.

At a Glance

- Bitcoin mining’s excess heat now warms 80,000 Finnish residents through district heating

- Superheat unveiled a water heater at CES 2026 that mines bitcoin while warming water

- Marathon Digital’s 2-megawatt pilot in Finland expanded to heat 11,000-plus homes

- Why it matters: The approach could offset heating costs by turning energy waste into revenue

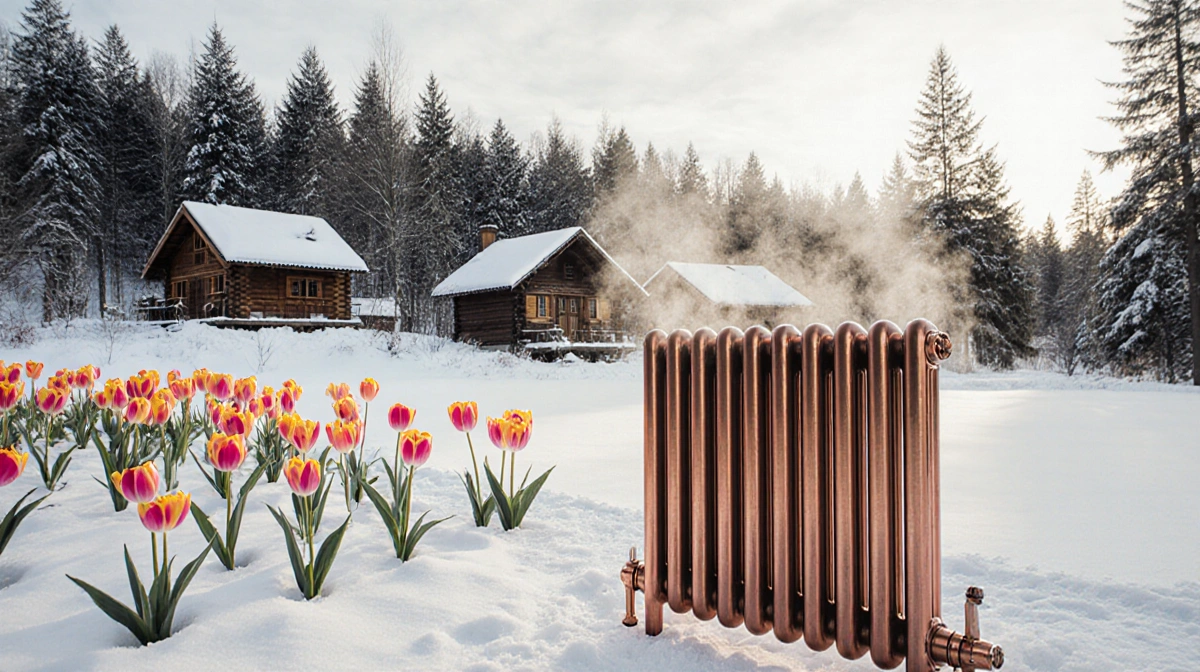

Bitcoin mining hardware crunches numbers and throws off serious heat-think old gaming laptop on steroids. For years tinkerers have floated a simple swap: capture that warmth to heat homes or greenhouses and let the mining profits chip away at the utility bill. The idea is moving from whiteboard to warehouse.

From Theory to Radiators

Finnish utility customers felt the shift this winter. Marathon Digital Holdings, one of North America’s largest miners, launched a 2-megawatt pilot in 2024 that piped hot water through underground lines to buildings in a community of 67,000. By December the firm tweeted it now supplies heat to nearly 80,000 residents nationwide, its second district-heating deployment in the country.

Consumer gadgets are following suit. At CES 2026 last week, Superheat pulled the wraps off a water heater that embeds a bitcoin miner inside a standard tank. The startup joins a small roster of companies already selling plug-and-play space heaters that double as miniature data centers:

- Heatbit markets a space-heater-sized unit for single rooms

- RY3T in Switzerland sells whole-home systems

- Softwarm targets U.S. customers with larger residential rigs

Greenhouses and Tulips

The heat-recycling concept stretches beyond living rooms. A Canadian greenhouse now uses mining rigs to keep tomato vines cozy through sub-zero nights. A Cornell study that examined global case studies concluded waste heat from crypto mines can improve energy efficiency and cut grower costs. Dutch growers even tested the approach for tulip production-an ironic nod to critics who liken bitcoin to 17th-century tulip mania.

Economics Still Murky

Whether the math works for ordinary households is an open question. Bitcoin mining is ruthlessly sensitive to electricity prices; cheap natural-gas heat can still undercut a hybrid rig once hardware, maintenance, and pool fees are tallied. Builders of plug-and-play heaters also expect a slice of any coins mined, trimming the consumer’s offset. If the miner inside a water heater bricks, repair costs can erase the savings.

Grid-scale complications add another asterisk. Power demand from AI data centers and industrial mines has helped push U.S. electricity rates higher, eroding the fractional edge these devices provide. Still, backers argue the goal isn’t to strike crypto gold-it’s to squeeze value from energy that would otherwise vanish up a chimney.

Key Takeaways

- District heating in Finland proves bitcoin waste heat can scale to city level

- Consumer appliances entering market let households experiment room-by-room

- Greenhouse pilots show niche agricultural uses where every therm counts

- Long-term savings hinge on local power prices and hardware reliability