At a Glance

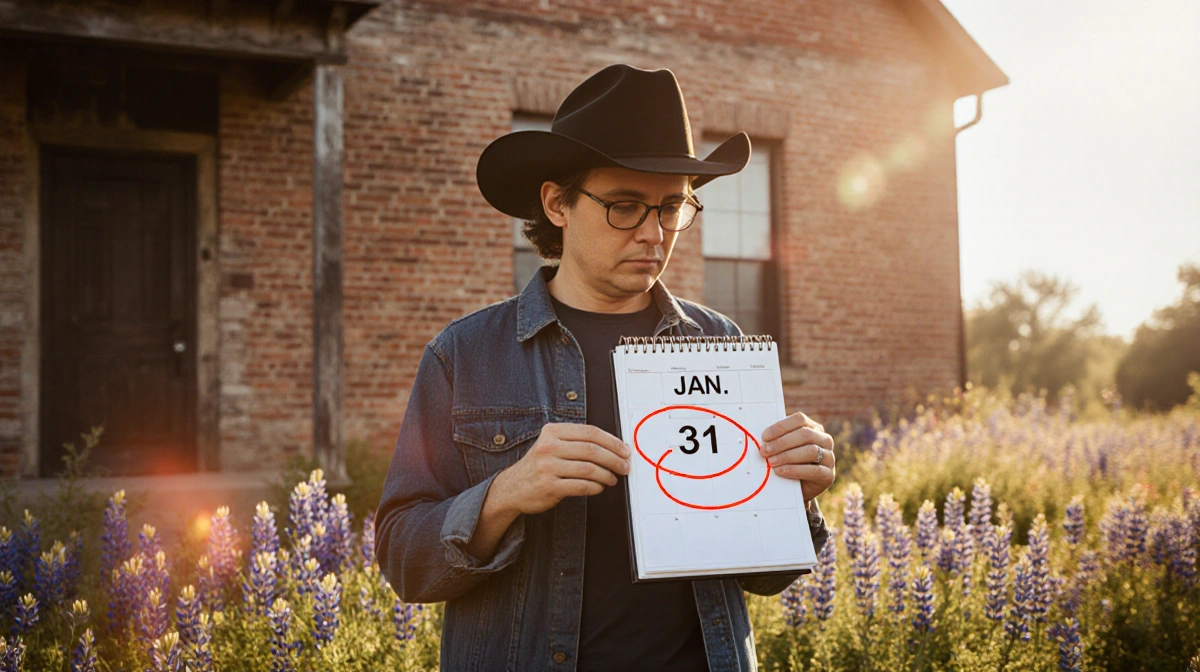

- Property tax payments are due by 11:59 p.m. Saturday, Jan. 31 for owners not using escrow or partial-payment plans.

- Last-minute online payers may hit system slowdowns as traffic spikes.

- Each North Texas county offers online, phone, mail, and in-person options with specific hours and fees.

- Why it matters: Missing the deadline triggers delinquency fees and potential legal action.

North Texas property owners have until January 31 at 11:59 p.m. to pay 2024 property taxes and avoid delinquency, News Of Fort Worth reported Monday. Payments can be submitted online, by phone, by mail, or in person, but officials warn that county websites may slow during final-hour rushes.

Collin County

Collin County accepts e-check, credit, and debit card payments through its online portal. Helpful hints are posted at the bottom of the page.

- Phone: 972-547-5020

- Office hours: 8 a.m.-4:30 p.m. weekdays

- In-person locations: List available here

Dallas County

Dallas County owners must search by full name on the tax office website to pull up their account. E-check is free; credit and debit cards incur a convenience fee.

- Mail: Payments must be postmarked by Jan. 31 to P.O. Box 139066, Dallas, TX 75313

- Phone: 1-877-253-0150

- Office hours: 8 a.m.-4:30 p.m. weekdays at all seven locations

- Email questions: propertytax@dallascounty.org

- Payment plans: Call 214-653-7811 or email special.inventory@dallascounty.org for zero-interest installment agreements

Denton County

Denton County’s payment portal accepts e-check, credit, and debit cards. Offices shift to a 10 a.m. open on Wednesdays.

- Phone: 940-349-3500

- Office hours: 8 a.m.-4:30 p.m. Mon., Tue., Thu., Fri.; 10 a.m.-4:30 p.m. Wed.

- Wait times: Check online before visiting

- FAQs: Posted here

Tarrant County

Tarrant County owners can pay online via the tax office site. Credit and debit cards carry a convenience fee.

- Phone: 817-884-1110

- Mail: Rick D. Barnes, Tax Assessor-Collector, P.O. Box 961018, Fort Worth, TX 76161-0018

- Office hours: 8 a.m.-4:30 p.m. weekdays

- Full details: Click here

Key Takeaways

- Don’t wait until the final hour-systems may lag under heavy traffic.

- Postmark matters-mailed payments must show a Jan. 31 date.

- Zero-interest plans are available in Dallas County for qualified owners.

- Keep confirmation numbers for online and phone payments as proof of timely filing.