At a Glance

- April 15 is the filing deadline for 2025 income year returns.

- New 2026 tax law raises standard deductions and adds new deductions for seniors, tips, and overtime.

- The IRS Direct File program will no longer be available when filing opens.

Tax season is approaching fast. With the April 15 deadline looming, taxpayers must also navigate new 2026 rules that apply to 2025 returns. Choosing the right software can simplify the process.

New 2026 Tax Rules for 2025 Returns

The One Big Beautiful Bill Act signed July 4, 2025 increases the standard deduction to $15,750 for single filers, $31,500 for married filing jointly, and $23,625 for heads of household. Seniors 65+ can claim an extra $6,000 (single) or $12,000 (married). Other changes include a $25,000 tip deduction, an overtime deduction of $12,500 (single) or $25,000 (married), and up to $10,000 of car-loan interest if you itemize and own a qualified vehicle. The IRS Direct File program will be suspended in January 2026, so taxpayers must use a commercial software platform.

- Standard deduction increases for all filing statuses.

- New senior deduction of up to $12,000.

- Deductible tips up to $25,000.

- Deductible overtime up to $25,000.

- Car-loan interest deductible up to $10,000.

Choosing the Right Tax Software

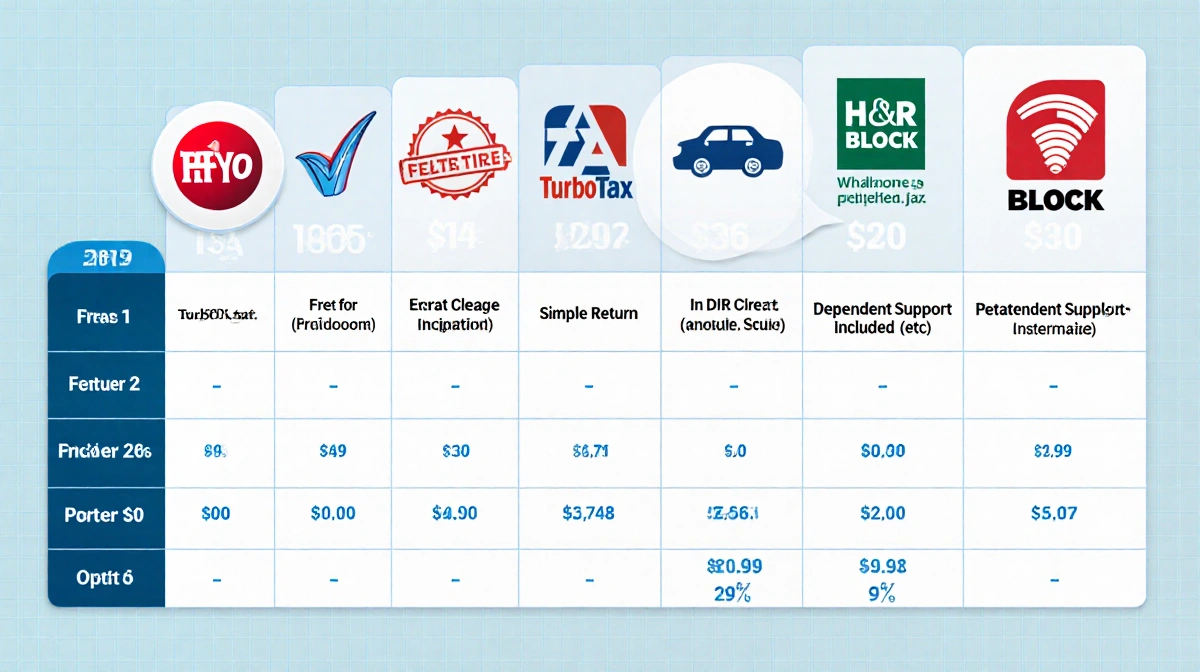

When selecting software, consider the complexity of your return, the price tiers, and the level of support you need. The seven major services offer free tiers for simple returns, but many require upgrades for dependents, 1099s, or state filings. Below is a quick comparison of their key features and pricing.

| Software | Free Tier | Best For | Paid Tier Start | Key Feature |

|---|---|---|---|---|

| H&R Block | Free | Most situations | $35 | AI assistant, optional pro support |

| TurboTax | Free | Complex returns | $0-$139 DIY | Interview-style questions |

| FreeTaxUSA | Free | Simple returns | $0 | Transparent pricing |

| TaxSlayer | Free | Self-employed / military | $22.99 | 1099-NEC import |

| TaxAct | Free | DIY with pro access | $29.99 | CPA/EA support |

| Cash App Taxes | Free | 100% free DIY | $0 | No paid tiers |

| Jackson Hewitt Online | Free | Flat-fee filing | $25 | Federal + state flat fee |

- H&R Block offers the best overall balance of price and tools for most filers.

- TurboTax excels when you have complex situations like self-employment or investment income.

- FreeTaxUSA is the most affordable for straightforward W-2 returns.

- TaxSlayer is ideal for gig workers and active-duty military.

- TaxAct provides live expert support for a modest fee.

- Cash App Taxes is a solid choice if you want a completely free, mobile-friendly experience.

- Jackson Hewitt Online is best when you need a flat fee that covers both federal and state returns.

Key Takeaways

- The 2026 law raises standard deductions and adds new deductions for seniors, tips, overtime, and car-loan interest.

- The IRS Direct File program will be unavailable in January 2026, pushing taxpayers toward commercial software.

- H&R Block tops the overall rating, while TurboTax and FreeTaxUSA shine in their respective niches.

Tax season may be fast approaching, but with the right software and knowledge of the new rules, filing can stay straightforward.